Table of Contents

Navigating a breakup involving property like a BTO flat can be tough. The rules and regulations governing the sale of BTO flats can be overwhelming and can add a layer of confusion in an already difficult time. Drawing from real-life examples, we offer insights to help navigate the aftermath of a breakup or divorce in Singapore during a BTO application. So, whether you are dealing with an uncooperative ex, navigating the aftermath of a premature BTO sale, or considering your options post-divorce, we’re here to support and guide you.

Understanding the BTO Matrimonial Home

BTO (Build-To-Order) flats are highly sought-after, especially among young couples in Singapore. These flats, part of the Housing and Development Board (HDB) initiative, offer affordable and quality housing options. During designated sales exercises, applicants choose from upcoming developments, marking the beginning of their BTO journey.

The process starts with the application phase, where couples select their flat and await construction—a period known as the Built-To-Order phase. As of 2024, the waiting time for your BTO could be around 3 and a half years. Once completed, these flats come with amenities provided by the HDB, catering to budding families’ needs.

It is crucial to note that BTO flats have a Minimum Occupation Period (MOP) during which owners cannot sell or rent out their flats. The MOP for BTO flats is 5 years; and 10 years for prime locations.

Eligibility criteria for BTO (Build-To-Order) flats in Singapore typically include:

- Citizenship: At least one applicant must be a Singapore citizen.

- Age: Applicants must be at least 21 years old at the time of application.

- Family nucleus: Eligible applicants may include:

- Public Scheme: Applicants applying with their spouse, parents, and children (if any).

- Fiance/Fiancee Scheme: Applicants intending to get married and apply together.

- Orphans Scheme: Unmarried siblings aged at least 21 years applying together.

- Income ceiling: There is a maximum income cap for eligibility, determined by factors such as household size and citizenship status.

- Previous property ownership: If you currently own residential properties locally or overseas, you’ll need to sell them before applying for a BTO. After selling, there’s typically a waiting period before you can submit a BTO application, with the duration varying based on your applicant type.

- Disqualification: Applicants with certain legal issues, such as undischarged bankruptcies, may be disqualified.

These criteria may vary slightly depending on the specific BTO project and any updates made by the Housing and Development Board (HDB). It’s essential for potential applicants to check the latest eligibility requirements before applying for a BTO flat.

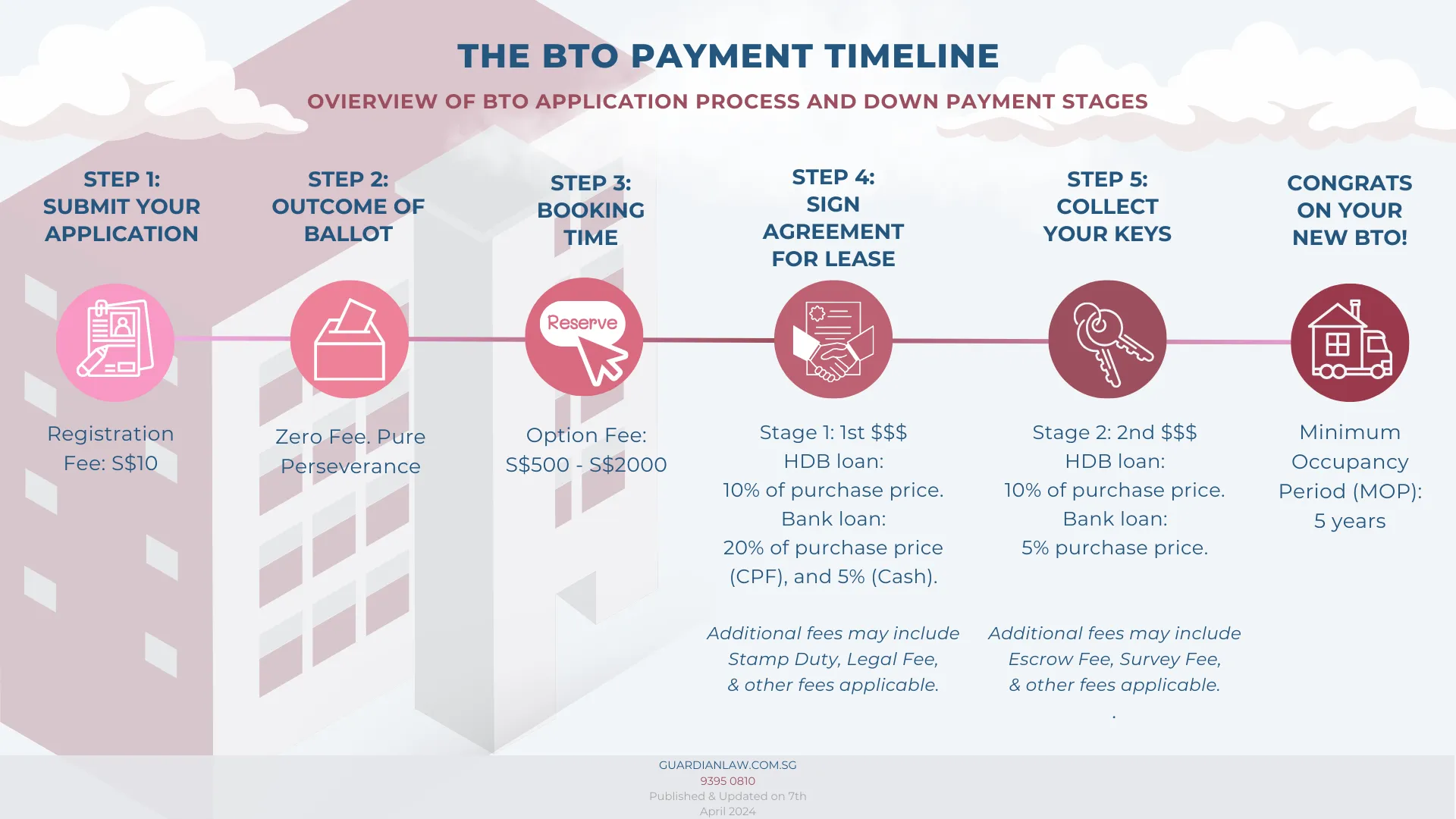

To get a bird’s eye view of the BTO procedure, from the initial application to key collection, our infographic below outlines the stages of the BTO application and the corresponding payments required at each step.

‘Uncoupling’ in the midst of the BTO process: 3 Major Considerations

While the Build-To-Order (BTO) system stands as a cornerstone of Singapore’s housing landscape, it’s not immune to complexities and challenges, especially when relationships hit rocky terrain.

One common question that arises is:

“What happens when a couple breaks up while in the midst of the BTO process?”

The BTO journey, spanning several years from application to the collection of the keys, can pose logistical and emotional hurdles if the relationship takes an unexpected turn.

We explore 3 major considerations if a couple breaks up before collecting their keys and moving in.

- Financial Implications

- Legal Obligations

- Next steps for your BTO

Consideration 1: Financial Implications

When couples apply for a BTO flat, they typically commit to the purchase together. However, if a breakup or a divorce occurs before the flat is ready for occupancy, or before the Minimum Occupancy Period (MOP) is reached, financial implications may arise. This includes forfeiting the initial down payment or other costs associated with termination of the flat purchase agreement with HDB prematurely.

Let’s take a second here to discuss the various costs of downpayment for a BTO.

🔎#A Case Study

Picture this: You and your spouse have been married for a year. Both of you are eager to take the next step and move out of your parents’ home to establish your own household. After browsing through numerous options, you both fall in love with a cozy 5-room BTO flat located in the heart of Punggol, surrounded by lush greenery and modern conveniences. The price tag reads S$500,000.

Certainly, the prospect of paying the full purchase price upfront can be daunting and nearly impossible for many, especially for young couples aspiring to start a family. Thankfully, the Singapore government provides various loan options and down payment schemes to ease this burden.

The down payment amount depends on whether you are,

- Taking a HDB housing loan.

- Obtaining a housing loan from a financial institution.

Depending on which housing loan you opt for, you can cover the down payment using cash and/or CPF Ordinary Account (OA) savings, which may include the CPF housing grant if eligible.

-

If you are taking a HDB housing loan,

The maximum amount you can borrow from HDB is 80% of the purchase price of the flat.

-

If you are obtaining a housing loan from a financial institution (i.e. bank),

Depending on your circumstance, you can either take a loan of 55%, or 75% of the purchase price of the flat. 75% being the maximum amount you can borrow from the bank.

The down payment amount is influenced by the type of loan you opt for, whether it’s from HDB or a bank.

Let’s break down the payment requirements for your dream HDB BTO Punggol flat (which is S$500,000 in this case):

| HDB loan (% of BTO Purchase Price of S$500,000) | Bank Loan (% of BTO Purchase Price of S$500,000) | |

Loan-to-value (LTV) Limit

| 80% of purchase price (S$400,000) | 75% of purchase price (S$375,000) |

| Balance Amount (Estimated Total of Downpayment to be Paid) *Note: The total amount provided here is not the final amount as it does not include stamp duty, legal fee (i.e. conveyance fee) and other fees applicable. | Balance 20% of purchase price (S$100,000) | Balance 25% of purchase price (S$125,000) |

| The balance amount stated above is the downpayment, and it is to be paid in 2 stages:Stage 1: During Signing of Agreement for LeaseStage 2: During Collection of Keys | ||

| HDB loan (% of BTO Purchase Price of S$500,000) | Bank Loan (% of BTO Purchase Price of S$500,000) | |

| Stage 1: During Signing of Agreement for Lease - 1st Downpayment | ||

10% of purchase price: (S$50,000) | 20% of purchase price: (S$100,000)

| |

| Additional Fees to be paid in Stage 1: Stamp Duty (Tax) - Up to 4% of purchase price (Free Tool: Stamp Duty Calculator). | ||

| Stage 2: During Collection of Keys - 2nd Downpayment | ||

Remaining 10% of purchase price (S$50,000) | Remaining 5% of purchase price (S$25,000) | |

Additional Fees to be paid in Stage 2: | ||

*Note: The example provided above is intended solely as a reference. Prices will vary depending on individual circumstances.

For further insights, you can visit the HDB website here, where comprehensive information is available. This includes detailed breakdowns of down payments and eligibility criteria for schemes like the Staggered Downpayment Scheme and others.

When is the BTO flat downpayment due?

To provide a clearer overview, we’ve created the following infographic illustrating the timeline of the various downpayments for a BTO. This infographic offers a comprehensive look at the stages involved in a BTO application and the corresponding amounts payable at each stage of the whole process.

To better understand the buying procedure of a BTO, you can visit the HDB website here.

Are there other financial implications I should be wary of?

In addition to forfeiting the downpayment, there may be additional charges incurred when returning a BTO flat to the Housing Development Board (HDB) or when selling it prematurely; before its completion or before the Minimum Occupation Period (MOP) has elapsed. These fees may include:

Forfeited Amounts

If the termination occurs before the flat’s completion or before fulfilling the MOP, there may be forfeited amounts, including the option fee and any down payment made.

Administrative Fees

There may be administrative fees charged by HDB for processing the termination of the flat purchase agreement.

Lawyer Fees

If legal assistance is sought to handle the termination process, there may be legal fees involved depending on the complexity of the case and the services required.

Conveyancing Fees

If the flat has progressed to a certain stage in the purchase process, conveyancing fees may apply, especially if legal documents need to be prepared or revised.

Other Costs

Depending on the specific circumstances, there may be additional costs involved, such as penalty fees for breaching contractual agreements or any outstanding payments owed to contractors or suppliers.

It’s essential to review the terms and conditions of the flat purchase agreement and consult with financial advisors or seek legal advice to understand the potential fees and implications involved in terminating a BTO flat purchase agreement.

Consideration 2: Legal Obligations

When it comes to the marital home in a break up or a divorce, couples must grapple with various legal obligations tied to their BTO flat.

Legal obligations tied to a BTO flat in the event of a breakup or divorce typically include:

-

Division of Matrimonial Assets

The couple needs to adhere to legal requirements regarding the division of their matrimonial assets, including the BTO flat. This involves determining each party’s share of ownership and the fair distribution of assets based on factors like contributions and needs.

-

Compliance with Housing Policies

Couples must ensure compliance with housing policies set forth by the Housing Development Board (HDB) or relevant housing authorities. This may involve fulfilling the Minimum Occupation Period (MOP) requirements before selling or transferring ownership of the flat.

-

HDB BTO Policies

HDB has stringent policies regarding the transfer or cancellation of BTO flat applications. While certain provisions exist for exceptional cases, such as death or severe medical conditions, navigating these policies can be complex and may not apply to relationship breakdowns.

-

Financial Responsibilities

Both parties are responsible for any outstanding mortgage payments, loans, or other financial obligations associated with the BTO flat. They must decide on how to manage these responsibilities fairly during the separation process to avoid prolonged legal battles.

-

Legal Documentation

Couples may need to navigate legal documentation such as property deeds, loan agreements, and HDB regulations when resolving issues related to the BTO flat. This includes understanding the implications of different legal arrangements, such as transferring ownership or selling the flat.

-

Child Custody and Support

If the couple has children, legal obligations regarding child custody, care, and financial support come into play. This issue may be further complicated when the addition of the BTO marital home comes into play. This may involve determining living arrangements and financial arrangements to ensure the well-being of the children during the divorce proceedings and post-divorce arrangements.

Understanding and addressing legal obligations is crucial for couples navigating breakup or divorce involving a BTO flat. Seeking legal advice ensures compliance with relevant laws and regulations, especially the division of the matrimonial home and assets. Failing to address these obligations can lead to protracted legal battles, complicating the divorce process. The repercussions of not addressing these obligations will be illustrated through a real-life scenario later on in the article.

Consideration 3: Next Steps For Your BTO

When faced with a breakup or divorce during the BTO process, it is vital to consider your next steps for your BTO flat. Below are some alternative options you can explore.

-

Retain the flat by transfer of ownership

If one partner wishes to retain the flat, they may explore the option of transferring ownership from both parties to one party. \

If eligible, one party may retain the flat, either alone or with another person, subject to meeting eligibility criteria.

-

Surrender or Return the Flat to HDB

Couples can choose to return the flat to HDB, particularly if neither party is eligible to retain ownership. It is important to note here that certain fees might be forfeited as discussed above.

-

Sell the Flat

If the Minimum Occupation Period (MOP) has been met, both parties may reach a mutual agreement to hold and sell the flat on the open market (typically in the case of a divorce).

After a breakup or divorce, the next steps for the BTO flat depend on various factors and legal guidelines. Each option has specific eligibility criteria and requirements. Children’s well-being should be prioritised when determining the fate of the BTO flat.

To simplify matters, we’ve categorised the next steps based on your relationship status regarding your BTO. Explore these scenarios to better understand your options.

#️⃣Scenario 1: Unmarried Couple

The process may be relatively simpler compared to a married couple, as there are typically fewer legal obligations involved.

Options for the unmarried couple include:

- Negotiating the reimbursement of the downpayment: You may agree to split the amount paid with your fiance, or decide on another arrangement.

- Terminating the BTO application: The flat must be returned to HDB, who may provide you with compensation that they deem appropriate.

Unmarried couples facing a breakup and needing to cancel their BTO flat purchase, you can find additional guidance on your options here.

#️⃣Scenario 2: Divorced Couple without Children

Navigating divorce proceedings and the division of your matrimonial home can be legally complex.

Options for the married couple include:

-

Negotiating the reimbursement of the BTO downpayment as part of your divorce settlement.

If there are no children from the marriage:

- Retain the flat alone if you are a Singapore Citizen, at least 35 years old, and meet the prevailing conditions under the Single Singapore Citizen Scheme (SCSS).

- Alternatively, include another person to retain the flat under an eligibility scheme, subject to meeting the prevailing conditions.

- Seek mediation or legal assistance to facilitate the resolution of financial matters and asset division of your marital home.

#️⃣Scenario 3: Divorced Couple with Children

The presence of children adds additional considerations, such as custody and child support arrangements.

Options for the married couple with children include:

- If you have custody (care and control) of your child, you may be eligible to retain the flat, provided certain eligibility conditions are met. HDB provides various schemes and subsidies to help single parent households.

- Depending on your financial situation and individual needs, you and your ex-spouse may consider the following options:

- Surrender or Retain:

- Surrender the flat back to HDB, or

- Retain the flat, subject to eligibility conditions.

- Transfer of Ownership: 3. If both mutually agree, keep the HDB BTO and transfer your ex-spouse’s share of the property to you (especially in cases where one spouse has custody of the children).

- Hold and Sell: 4. If both mutually agree, hold onto the flat until the Minimum Occupation Period (MOP) is fulfilled, then sell it on the open market.

- Consider seeking mediation or legal assistance, especially if children are involved, to navigate the complex BTO process and address custody and living arrangements effectively.

For more information on the eligibility conditions to sell your flat, please refer to the HDB website here.

Investigating a Real-Life Scenario: Navigating a Bitter Divorce During a BTO Application

Article Title: “Couple fight over ‘windfall’ from BTO flat in Tampines”

Source: The Straits Times

Article Date: 31 Mar 2024

Overview:

In a recent article by The Straits Times, a married couple’s turbulent divorce amid their Build-To-Order (BTO) application in Tampines sheds light on the complexities of such proceedings. Despite not finalising their BTO purchase or collecting their keys, the couple faced a bitter legal battle over the BTO flat, with the husband adamant about returning it to the HDB to prevent his ex-wife from gaining a potential windfall (A windfall is an unexpectedly large or unforeseen profit).

Timeline of the Couple’s Divorce and their Harrowing BTO Journey.

-

July 2017: The couple applied to purchase the flat from HDB at a price of S$467,000.

-

January 2019: The husband left and stopped living with his wife and children.

-

March 2019: The wife commenced divorce proceedings.

-

February 2020: An Interim Judgment was granted.

-

May 2021: Various rulings were made by the court, including joint custody of the children with care and control granted to the wife. However, the BTO flat, considered the matrimonial home, was to be surrendered or returned to HDB. The wife appealed this decision.

-

Between May 2021 - 2023:

The wife appealed to the Appellate Division of the High Court, offering to reimburse her ex-husband for his share of the flat’s downpayment, with accrued interest, in exchange for the transfer of his interest in the property to her, a proposal she initially refused. Both parties had paid S$16,000 each in downpayments and fees by then. A valuation of the flat showed that its current value remained at S$467,000, the same as its purchase price in 2017, due to the unmet Minimum Occupation Period (MOP) of 5 years.

-

2023: The High Court granted the wife’s appeal, deeming the flat a matrimonial asset. The decision prioritised the welfare of the couple’s children, granting care and control to the wife, and ensuring they had a permanent roof over their heads and a place to finally call home.

Here are various angles to explore concerning the husband and wife in this real-life scenario:

♂️🚹The Husband’s Perspective:

-

Financial Concerns: The husband may prioritise financial considerations, viewing the BTO flat as a significant investment and being reluctant to continue financing it if he won’t directly benefit.

-

Legal Strategy: His actions regarding the BTO flat may be driven by legal strategies to protect his interests and assets during the divorce proceedings.

-

Emotional Factors: There might be underlying emotional reasons for his decisions, such as resentment or bitterness towards his ex-wife, influencing his stance on the BTO flat.

-

Future Plans: He may be considering his future housing options, especially if he plans to start a new family. By retaining the BTO flat, there will be limited housing options as a second-timer for HDB purchases, potentially leading to additional costs like Additional Buyer’s Stamp Duty (ABSD).

♀️🚺The Wife’s Perspective:

Stability for Children: Although initially refusing to refund her ex-husband’s deposit payment of S$16,000, the wife eventually prioritises stability and a secure home environment for her children, hence her efforts to retain ownership of the BTO flat.

Emotional Toll: She may be experiencing significant emotional stress and strain from the divorce proceedings, compounded by the uncertainty surrounding the BTO flat.

Financial Independence: The wife’s willingness to reimburse her ex-husband for his share of the BTO flat’s costs reflects her desire for financial independence and stability for herself and her children.

By examining these various perspectives, we gain a deeper understanding of the complexities involved in this real-life scenario.

Key Takeaways:

- Returning HDB flats to HDB upon divorce is uncommon, with couples typically retaining them for financial gains or children’s stability.

- Contested divorces can lead to prolonged, bitter divorce proceedings as illustrated by this case. Despite initiating divorce proceedings in 2019, the couple endured a lengthy 4 year ordeal before the court ultimately reached a decision in 2023.

- Cooperation between spouses can lead to more financially sound decisions and minimise emotional strain, particularly for children.

- Divorce proceedings can begin during the BTO process. However, parties must agree to retain the property till after Minimum Occupation Period (MOP) is over. This ensures that parties do not suffer from a financial loss of having to surrender the flat to HDB.

- Address property disputes amicably early on to minimise financial and emotional strain.

- Prioritising the welfare of the children by seeking an amicable resolution and stable living environment is crucial to mitigate the negative impact of divorce on their lives.

- Embrace mediation as an alternative dispute resolution method for more amicable outcomes.

- Explore simplified uncontested divorce options for a smoother and less adversarial process.

Simplified Uncontested Divorce: A Viable Alternative

What is a Simplified Uncontested Divorce?

Simplified uncontested divorce is a collaborative legal process where spouses mutually agree to the terms of the divorce without extensive litigation. Couples work together to resolve key issues like child custody, asset division, and spousal maintenance. This approach fosters cooperation and compromise, leading to a quicker and less costly resolution compared to contested divorces.

In simplified uncontested divorce, one party initiates the divorce proceedings with the mutual consent and agreed terms of the other party. The court reviews the terms, and upon approval, finalises the divorce swiftly. This approach is beneficial for couples willing to amicably dissolve their marriage, reducing emotional and financial strain. It also facilitates a smoother transition for spouses and any children involved, including the division of assets like the BTO marital home.

To learn more about Simplified Uncontested Divorce, read our article here.

How a Simplified Uncontested Divorce could have helped in this case:

-

Efficiency in Resolution

A simplified uncontested divorce could have expedited the resolution of the divorce proceedings, allowing the couple to reach a mutually agreeable settlement without the need for extensive litigation.

-

Reduced Conflict

By opting for a simplified uncontested divorce, the couple could have minimised conflict and animosity between them, fostering a more amicable and cooperative environment, which is particularly crucial for the well-being of their children.

-

Clear Agreement on Asset Division

Through a simplified uncontested divorce process, the couple could have clearly outlined their agreement regarding the division of assets, including the BTO flat, without the need for prolonged legal battles and multiple court hearings.

-

Child-Centric Approach

A simplified uncontested divorce would have allowed the couple to prioritise the best interests of their children, ensuring that their needs for stability and a permanent home are met without unnecessary delays or complications.

-

Financial Savings

By avoiding the costs associated with protracted litigation and court proceedings, a simplified uncontested divorce could have resulted in significant financial savings for both parties, allowing them to allocate resources more effectively for themselves and their children.

-

Emotional Well-being

Choosing a simplified uncontested divorce would have alleviated much of the emotional strain and stress experienced by both spouses throughout the divorce process, enabling them to focus on moving forward with their lives and co-parenting their children effectively.

In summary, a simplified uncontested divorce could have facilitated a smoother, more efficient, and less contentious resolution of the case, ultimately benefiting all parties involved, especially the children.

Moving Forward After a Breakup or Divorce

Navigating a breakup or divorce during the BTO process can be overwhelming. Prioritise self-care, seek support, and address practical matters like asset division through clear communication and possibly legal assistance. Setting realistic goals and embracing new opportunities can help you transition smoothly. Remember, healing takes time, but with patience and determination, you can emerge stronger on the other side.

Resources Available for Individuals Facing Similar Situations:

Non-Profit Organisations

-

DivorceCare: A non-profit organisation that offers support groups, resources, and seminars for individuals going through divorce.

-

CareCorner: A local social service agency in Singapore that offers various support services, including counselling and family support programs, which may also assist individuals and families dealing with divorce-related issues, including those involving BTO flats.

Online Platforms and Support Groups

-

Online Therapy Platforms: both BetterHelp and TalkSpace are online therapy platforms also available in Singapore that offer counselling and therapy services. These platforms provide convenient access to licensed therapists through messaging, phone calls, and video sessions, making mental health support more accessible to individuals in Singapore.

-

Church or Community-Based Support Groups: Many churches and community centres host support groups specifically for individuals going through divorce, providing a safe space to share experiences and receive support.

Government Agencies and Programs

-

Ministry of Social and Family Development (MSF): The MSF in Singapore provides comprehensive support for families undergoing divorce. They offer various programmes and counselling services, financial assistance, and resources aimed at helping divorced parents and the children of divorce adjust to their new circumstances.

-

Single Parent’s Scheme: Government scheme providing financial support and resources specifically tailored to single-parent households, helping individuals navigate the challenges of single parenthood after divorce.

These resources can offer valuable support, guidance, and assistance to individuals navigating the emotional and practical challenges of divorce, helping them cope and move forward with their lives.

Conclusion

In conclusion, navigating the complexities of divorce and breakup, especially concerning the fate of a BTO marital home, requires careful consideration and proactive steps. By prioritising cooperation, communication, and compromise, couples can minimise the emotional and financial strain of the divorce process, including issues with the division of assets like the BTO marital home. Utilising resources and support services, such as those offered by the Ministry of Social and Family Development (MSF), can provide valuable guidance and assistance during this challenging transition.

At Guardian Law, we understand the intricacies of family law and are committed to helping our clients navigate divorce proceedings with empathy and expertise. Our team of experienced lawyers is dedicated to achieving amicable resolutions and protecting the best interests of our clients and their families, including the equitable division of assets like the BTO marital home. If you’re facing divorce or breakup and need legal assistance, contact us today for personalised support and guidance.

Need Help?

”

Facing a divorce or breakup involving your BTO flat? Wondering about Simplified Uncontested Divorces? Our team at GuardianLaw is here to assist you. Feel free to reach out to us through any of the following channels:

Contact us here or Whatsapp us and we will get back to you within 1 working day.

We are here to help!

Frequently Asked Questions

Can I buy a BTO in the midst of my divorce proceedings?

No, you cannot. But once you’ve finalised your divorce, you have the opportunity to buy a subsidised flat, provided you meet certain eligibility criteria. During the waiting period for this process, you may explore purchasing a BTO (build-to-order) flat through the ASSIST (Assistance Scheme for Second-Timers) or opt for a resale flat instead.

Will my BTO downpayment be forfeited if my marriage got called off?

If your marriage got called off before the BTO completion and you have already paid the downpayment, there is a possibility that your downpayment may be forfeited. It depends on the terms and conditions set by HDB and the specific circumstances of your case, like if there are children involved.

Can divorced individuals apply for BTO?

After obtaining the Interim Judgment of divorce and settling ancillary matters, both parties in a divorce can apply for a subsidised flat. Divorced or widowed parents purchasing a new flat with their children may qualify for schemes like the Assistance Scheme for Second-Timers (Divorced/Widowed Parents) (ASSIST) and Parenthood Provisional Housing Scheme (PPHS), provided they meet the relevant eligibility criteria set by the Housing and Development Board (HDB).

What happens if me and my fiance break up before BTO completion?

You would have to terminate your BTO application to HDB. The consequences of terminating your BTO application vary depending on which stage you are in in the BTO process. Generally, forfeiting your option fee or 5% of the flat purchase price is required. Additionally, a one-year waiting period is typically imposed before you can reapply for subsidised housing.

Can I get a divorce but still cohabit with my ex spouse in our HDB BTO till it reaches MOP?

Although getting a divorce while continuing to cohabit in your HDB BTO until it reaches the Minimum Occupation Period (MOP) is legally feasible, it requires mutual agreement between both parties. If both spouses are amenable to the arrangement, they can reside together in the BTO until the MOP is fulfilled. However, it's crucial to establish clear terms regarding the eventual sale of the property once the MOP is reached. Agreeing in advance on the sale of the property post-MOP can prevent potential conflicts and ensure a smooth transition when the time comes to part ways.