Table of Contents

- expand_circle_right Understanding Lasting Power of Attorney (LPA) in Singapore

- expand_circle_right Powers and Responsibilities of a Donee

- expand_circle_right Safeguarding Against Misuse of LPA

- expand_circle_right LPA Certificate Issuers

- expand_circle_right The Application Process for an LPA

In Singapore, a Lasting Power of Attorney (LPA) enables you to appoint trusted individuals as ‘Donees’ to handle your personal and financial decisions if you ever lose mental capacity. This article breaks down what an LPA is, its significance in safeguarding your future, and how to apply for one, ensuring that you are well-informed to make this critical legal arrangement.

Imagine this scenario.

_You’re involved in a sudden car accident and left incapacitated (mentally unsound), unable to make decisions about your own welfare or finances. Who would step in to ensure your affairs are handled properly and your best interests are protected? _

This is where the concept of Lasting Power of Attorney (LPA) comes into play.

Understanding Lasting Power of Attorney (LPA) in Singapore

An LPA is a legal document that allows you to designate one or more individuals, called Donees, to make decisions for you if you become mentally incapacitated.

Who Can Make an LPA

If you think LPAs are only for the elderly, think again.

An LPA can be made by anyone aged 21 or above. This should not only be for the old, but even for young adults who may face unforeseen circumstances. Planning ahead and ensuring that your affairs are taken care of is crucial in safeguarding your future. It’s especially relevant for individuals with dependents (such as special needs), significant assets, or specific preferences about their care and finances after they pass on.

The Importance of an LPA

An LPA is not just a piece of paper; it’s a safety net. Without an LPA, your family could face difficulties in managing your care arrangements, finances, property, and affairs. They would need to apply to the Court to become deputies, a process that’s more time-consuming and costly than creating an LPA. An LPA can alleviate the stress on your loved ones in an already challenging time.

🔎Let’s use a real life scenario to zoom in on the importance of an LPA.

Imagine this scenario.

John, a 65-year-old retiree, had been putting off creating a Lasting Power of Attorney (LPA) despite his family’s urging. He believed that since he was in good health and had no immediate plans to relinquish control over his finances or personal welfare, there was no rush to make an LPA.

However, tragedy struck when John suffered a sudden stroke, leaving him incapacitated and unable to make decisions for himself. Without an LPA in place, John’s family faced significant challenges in managing his affairs and ensuring his welfare. Additionally, without a designated decision-maker, John’s family had to navigate a complex and costly Court process to make decisions on his behalf, causing delays and disagreements among his family.

_Meanwhile, to top it all off, John’s assets remained inaccessible, leading to financial strain and delays in accessing necessary care and support services not only for John’s hospital and medical fees, but also for any loved ones that are dependent on John. As such, more disagreements arose among family members regarding decision-making authority, further complicating matters during an already stressful time. _

In hindsight, by procrastinating on creating an LPA, John had inadvertently placed a heavy burden on his loved ones and exposed himself to unnecessary risks and uncertainties.

Remember, an ounce of prevention is worth a pound of cure.

The 2 Different Types of LPAs and Their Purposes

Selecting the appropriate LPA form is of utmost importance. In Singapore, there are two LPA forms designed to cater to individual needs.

- LPA Form 1: For people who want to give their chosen person certain powers, but with some basic limitations.

For example,

A mother wants to appoint her daughter as her Donee to make decisions about her healthcare if she becomes unable to do so herself. However, the mother wants to limit her daughter’s authority to only healthcare-related decisions, such as medical treatments, surgeries, and end-of-life care. The mother decides to use LPA Form 1 to grant her daughter to make decisions relating to her personal welfare only and to impose basic restrictions, ensuring that her daughter’s powers are focused solely on her healthcare needs.

- LPA Form 2: For people who want to customise the powers they give to their chosen person. If you choose LPA Form 2, you’ll need a lawyer to help you write down exactly what powers you want to give.

For example,

A successful entrepreneur wishes to appoint his long-time business partner as his Donee to manage both his personal and business affairs in case he becomes mentally incapacitated. However, the successful entrepreneur has specific preferences and wants his business partner to have comprehensive authority over his financial matters only. This includes access to bank accounts, managing his stake in shares, investment decisions, and property transactions. The entrepreneur decides to use LPA Form 2, with the help of a lawyer, to customise the powers granted to his partner. This ensures that his business interests are properly managed according to his instructions.

The choice between LPA Form 1 and Form 2 depends on your specific needs and circumstances. It’s not a one-size-fits-all scenario, it’s about what works best for you.

What is the difference between a POA (Power of Attorney) and LPA (Lasting Power of Attorney)?

You might be wondering, “Isn’t a Power Of Attorney (POA) the same as an LPA”? While they seem similar, there’s a key difference.

A Power Of Attorney (POA) enables you to appoint someone to act on your behalf while you are mentally capable but may be absent or unavailable, like being overseas or bedridden, or even going to prison.

However, a POA becomes invalid once you lose mental capacity.

An LPA comes into play specifically when you lose mental capacity, granting authority to a Donee to make decisions related to your personal welfare, property, and affairs.

If you’re still puzzled about the difference between a Power Of Attorney (POA) and a Lasting Power of Attorney (LPA), let’s clarify things with some real-life situations. These examples will help you grasp the differences more easily.

Imagine this Scenario for Power of Attorney (POA):

Jane, a successful businesswoman, appoints her sister, Sarah, as her Attorney while she travels abroad extensively for work. With Jane’s authorization, Sarah manages her financial affairs, signs contracts, and handles various legal matters on her behalf, including the sale of her property.

Tragedy strikes when Jane is involved in a serious car accident that leaves her with severe brain injuries. Despite her physical recovery, Jane suffers from cognitive impairments and is unable to make decisions or manage her affairs independently.

Luckily, prior to the accident, Jane had taken proactive steps to establish a Lasting Power of Attorney (LPA), appointing her brother, Mike, as her Donee. Unlike the POA, which becomes invalid once Jane loses mental capacity, the LPA kicks in precisely at this juncture.

With the LPA in place, Mike assumes the role of decision-maker, empowered to act on Jane’s behalf in matters related to her personal welfare, property, and affairs. This seamless transition from the POA to the LPA ensures that Jane’s interests continue to be protected, even in the face of unexpected adversity.

The Power of Attorney (POA) had granted Sarah the authority to act on Jane’s behalf whilst she was overseas. It did not relate to Jane’s mental capacity. The LPA on the other hand, immediately came into effect upon Jane losing her mental capacity.

Unlike POAs, LPAs do not have a validity period and remain effective throughout incapacity, offering ongoing support and protection tailored to individual needs and preferences.

Key components of an LPA

In Singapore, the legal framework for LPAs is governed by the Mental Capacity Act. This act allows individuals to create an LPA (i.e. LPA Form 1 or Form 2), designating one or more ‘Donees’ to make decisions on their behalf if they become incapacitated. LPAs provide peace of mind and ensure the individual’s wishes are carried out when they cannot make decisions for themselves. To create a valid LPA in Singapore, you must:

- Be at least 21 years old.

- Have the mental capacity to make the LPA.

- Not be bankrupt if appointing a Donee to handle your personal property and affairs.

- Register the LPA with the Office of Public Guardian (OPG).

Key components of an LPA encompass more than just signing a form. Additionally, it involves the certification process, where an accredited medical practitioner, a practising lawyer, or a psychiatrist, certifies that you comprehend the LPA’s purpose and the authority granted to the Donee(s).

This certification process is crucial for ensuring the integrity and validity of the LPA, as we will discuss more about this later in this article.

For detailed guidance on applying for a Lasting Power of Attorney (LPA) and step-by-step instructions, please read our other article here.

Powers and Responsibilities of a Donee

Upon appointing a Donee, it’s essential to comprehend the responsibilities and powers they will possess. A Donee is tasked with making decisions on your behalf that could encompass your whole estate; be it personal welfare, property, or financial matters, added with specific exclusions mandated by law.

What Decisions Can a Donee Make?

The table below illustrates the wide range of powers that a Donee may be granted in an LPA and the corresponding responsibilities they must uphold.

| Powers Granted to Donee(s) | Responsibilities |

| Day-to-day decision-making | Making decisions regarding day-to-day matters like what to eat (for e.g. if the Donor is diabetic, the Donee should make choices that align with a low sugar diet) and what to wear. |

| Making medical decisions on healthcare | Consulting and communicating effectively with healthcare professionals, advocating for the Donor’s medical preferences and wishes regarding treatment. |

| Living arrangements | The Donee may be tasked with deciding on suitable living arrangements for the Donor, such as moving to an assisted living facility or arranging for in-home care services, based on the Donor’s needs and circumstances. |

| Managing finances | Ensuring bills are paid on time, managing investments responsibly (for e.g. conducting research to make informed investment decisions when needed), and maintaining accurate record-keeping. |

| Accessing digital assets | Protecting the Donor’s online accounts and sensitive information, adhering to cyber-security best practices. |

| Selling property | Acting in the Donor’s best interest, ensuring fair market value, and handling legal documentation related to property transactions. |

| Applying for government benefits | Staying informed about available benefits, ensuring the Donor receives entitled benefits to the fullest extent. |

| Representing the Donor in legal proceedings | Seeking legal advice when necessary, engaging competent legal representation, and providing accurate information to legal professionals to represent the Donor’s best interests. |

These responsibilities may vary depending on the specific instructions, or powers, outlined in the LPA and the circumstances at hand. Overall, the primary objective of the Donee is to promote the Donor’s well-being and uphold their preferences by acting on their behalf.

“With great power, comes great responsibility” > – Uncle Ben, Spiderman’s uncle 🕷️🕸️

Now that we have explored the powers and duties of a Donee, what about their limitations? Are there restrictions in regards to the authority given to a Donee?

Restrictions on a Donee(s) Powers

Sections 13 and 14 of the Mental Capacity Act set rules and conditions that limit what a Donee can do. These include:

-

Decision making and ability

A Donee can make decisions for the Donor only if the Donor is unable to make those decisions or if the Donee thinks the Donor can’t make them.

-

Restraining the Donor

The Donee can only physically stop the Donor if it’s necessary to keep them from getting hurt. The level of restraint should be appropriate, considering how likely and severe the potential harm might be.

-

Medical and health decisions

The Donee can make decisions about the Donor’s health care, including consenting or refusing treatment, but only if the LPA specifically says so.

This includes decisions about participating in clinical trials or other medical research.

-

Life-sustaining treatment

The Donee is not allowed to decide about life-saving treatments or other treatments needed to stop serious health problems. Essentially, the Donee needs explicit legal permission to make these critical health decisions.

-

Property and financial decisions

The Donee can’t make or change decisions about certain financial matters—like naming beneficiaries in insurance policies, making or changing wills, or handling specific savings accounts like CPF (Central Provident Fund)—unless stated in the LPA.

-

Certificates of incapacity

When handling the Donor’s care or property, the Donee may need to provide a medical certificate showing that the Donor’s inability to make decisions is likely permanent. If the Donee doesn’t have this certificate, their power to make decisions might not be recognised.

-

Gifts

The Donee can only give gifts from the Donor’s property if the LPA allows it. The gifts should be reasonable, relative to the size of the Donor’s assets.

Although LPAs are meant to ensure the Donor’s welfare and financial security, they can sometimes be exploited.

Recognising and addressing the potential for abuse is crucial, especially to prevent financial exploitation of vulnerable individuals like the elderly.

Safeguarding Against Misuse of LPA

Though an LPA is a potent tool in safeguarding your interests, being aware of potential misuse is equally important. Unfortunately, LPAs can potentially be misused by Donees to commit financial abuse, particularly of elderly individuals.

Let’s take a look at such cases.

Elder abuse: A Growing Concern in an Aging Society

Elder abuse, a pressing issue in societies with ageing populations like Singapore, poses a significant concern within the context of LPAs. Donees, entrusted with decision-making authority, can exploit LPAs for personal gain, leading to mistreatment of vulnerable elders. If you suspect a case of abuse, you could look out for some warning signs.

Let’s explore some situations:

-

Financial Exploitation

⚠️What it involves

Using the elder’s money or assets without permission. This could involve transferring money to their own account, making their own personal purchases, selling the Donor’s belongings, or paying personal bills, all without the Donor’s authorisation.

❗Warning signs

-

Unexplained withdrawals or transfers from the elder’s bank account

-

Sudden changes in the elder’s financial situation

-

Missing valuable possessions without explanation

-

Unpaid bills despite the elder having sufficient funds

-

Neglect of Care

⚠️What it involves

Ignoring the elder’s medical needs, skipping their treatments or medication, or leaving them in unsafe conditions.

❗Warning signs

-

Unaddressed health issues or untreated medical conditions

-

Lack of proper hygiene or medical care

-

Unsafe living conditions, such as inadequate food or shelter

-

Emotional Abuse

⚠️What it involves

Threatening, manipulating, or verbally attacking the elder to control their behaviour or decisions.

❗Warning signs

-

Frequent arguments or tension between the elder and their caregiver

-

Elder displaying signs of fear or anxiety around the caregiver

-

Changes in the elder’s behaviour or mood, such as withdrawal or depression

-

Caregiver belittling or insulting the elder

-

Isolation

⚠️What it involves

Cutting off the elder Donor from friends, family, or support networks, or limiting their communication and mobility.

❗Warning signs

-

Elder suddenly being isolated from family members and friends

-

Caregiver controlling the elder’s access to phones, mail, or visitors

-

Unexplained restrictions on the elder’s mobility or social activities

-

Physical Abuse

⚠️What it involves

Physically harming the elder through hitting, restraining, or using force.

❗Warning signs

-

Unexplained bruises, cuts, or other injuries on the elder’s body

-

Elder displaying fear or discomfort around the caregiver

-

Caregiver being overly aggressive or controlling in their interactions with the elder

By recognising these warning signs associated with each form of abuse, it becomes evident how a Donee may exploit their authority under an LPA for personal gain, disregarding the well-being of the elder in their care.

🚫If you or someone you know is being abused, seek help by contacting the Singapore National Anti-Violence & Sexual Harassment Helpline at 1800-777-0000 or you can also make an online report here.

Alternatively, you can find more information on elder abuse here.

🚨📢It might be worthwhile to note that under the Mental Capacity Act, caregivers are provided with whistle-blowing protection when reporting suspected abuse. This ensures that your privacy is respected and your concerns are addressed with confidentiality.

The Role of the OPG

The Office of the Public Guardian (OPG) plays a crucial role in safeguarding against the misuse of LPAs by Donees. As the regulatory body responsible for registration and supervision of LPAs in Singapore, the OPG ensures that Donee(s) fulfils their duties in accordance with the law and ethical standards.

The Office of the Public Guardian holds supervisory and investigative authority to address alleged abuses or misuse of powers. If a Donee is found to act against the best interests of the incapacitated person, the Public Guardian may seek Court intervention to revoke their authority.

If a Donee is found abusing his or her power, he or she may face severe penalties (e.g. fine and/or imprisonment, under section 42 of the Mental Capacity Act).

What to do in case of suspected misuse of an LPA?

It’s crucial to act promptly upon suspicion of abuse or misuse of power, especially since many vulnerable individuals depend entirely on their appointed Donee(s). If uncertain about the appropriate steps, seeking legal assistance is advisable. Additionally, contacting the Office of Public Guardian (OPG) is recommended, as they have the authority to initiate legal proceedings against Donees.

However, prevention supersedes cure and incorporating specific instructions and limitations in your LPA can act as a deterrent to misuse.

Click here to see the contact list of places that you can approach to seek help if there is suspected misuse.

LPA Certificate Issuers

Once you’ve selected your donees and determined the powers to grant, certification of your LPA is the next step.

The Certification Process Explained

The certification process involves:

- Verifying that you, the Donor, comprehend the LPA’s purpose.

- Ensuring no fraud or undue pressure was involved in its creation.

- The certificate issuer signs the LPA Form as a witness to this understanding.

*Please note that fees for this certification service vary depending on the issuer chosen.

The certification process is an important step that ensures there was no fraud or undue pressure involved in its creation, affirming the validity of the LPA.

Why Choose Guardian Law for LPA Certification?

Guardian Law - Your Trusted LPA Certification Issuer

At Guardian Law, we’re your trusted experts in certifying LPAs. We ensure a thorough understanding of LPA implications, verify the process is free from coercion, and tailor our services to your needs. With package pricing for Wills and LPAs, we offer comprehensive legal coverage at transparent rates.

Please note that our professional fees vary depending on the complexity of each LPA case, with Form 1 applications incurring lower fees compared to Form 2 due to their simpler nature. This ensures fair and transparent pricing for our valued clients, with Form 1 being a more cost-effective option for many individuals.

The Application Process for an LPA

While the process of applying for an LPA may appear intimidating, it’s actually well-organised and manageable. When you’re filling out LPA Form 1, there are specific steps to adhere to. From choosing your Donees to having your LPA registered and certified, each step is crucial to ensure that your LPA is legally valid and reflects your wishes accurately.

*Please be aware that this application process only applies to individuals applying for LPA Form 1. LPA Form 2 must be drafted by lawyers, so no action is required for Form 2.

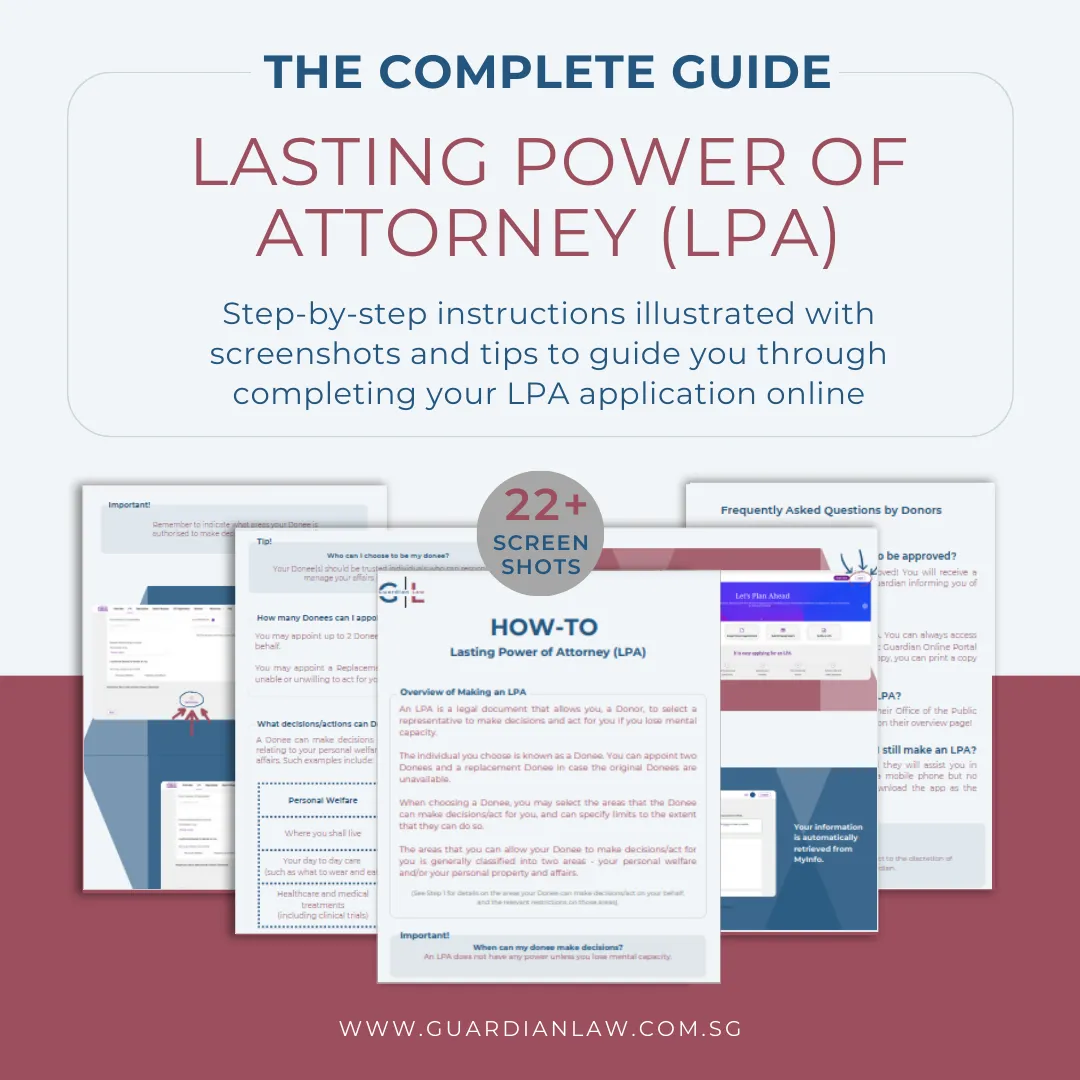

Dive into our detailed article, “How To Make An LPA: Lasting Power of Attorney Guide”, where we offer comprehensive, step-by-step instructions enhanced by screenshots and tailored advice to support you throughout the process. We’ve also curated a specially designed e-manual for a more visual learning experience, complete with a FAQs page that addresses common questions.

Alternatively, you can download and get your own copy of the e-manual directly from clicking the link below!

Free Download!

Download Your Essential LPA E-Manual Now!

Click on the FREE DOWNLOAD button below to download our LPA E-Manual.

The e-manual provides step-by-step instructions to navigate the LPA application process effortlessly - embark on your LPA journey worry-free!.

- Instant Download

- Multiple Device Compatible

Overview of How to Apply for Your LPA Online

If you’ve missed out on our comprehensive guide to applying your LPA online above, we have summed up some essential information for your careful consideration.

Applying for an LPA is a step-by-step process:

- Creating a Lasting Power of Attorney (LPA)

📝 Form 1 Application:

-

Visit the OPG Online (OPGO) website to complete Form 1 for your LPA application.

OPGO is an online platform for transactions with the Office of the Public Guardian (OPG).

-

Grants basic powers to your Donee(s).

-

No need for lawyer assistance.

📝 Form 2 Application:

- Needed for specific scenarios - Examples include appointing more than 2 Donees or appointing more than 1 replacement Donee.

- Grants customised powers to your Donee(s).

- Requires lawyer assistance to complete LPA Form 2.

-

Preparing Your LPA Application Online

To initiate an LPA (Form 1) application online, you’ll require a Singpass account and the necessary details of your chosen Donee(s). You should have the following details on hand at this step, including your Donee(s):

-

Full name

-

NRIC or FIN number

-

Local mobile number; and

-

Email address (optional)

Once submitted, your chosen Donee(s) will receive a notification via SMS to accept or reject their appointment through the Office of the Public Guardian Online (OPGO) by logging in with their Singpass.

-

Visiting a Certificate Issuer

After all chosen Donees have accepted their appointment on the online portal, your LPA must be certified. Certification can be done by:

-

A medical professional accredited by the Office of the Public Guardian (OPG).

-

A registered psychiatrist.

-

A practising lawyer (excluding those registered under section 36E of the Legal Profession Act 1966).

Confirm that the chosen certificate issuer can certify your LPA online. You would also need to download the Singpass app on your mobile phone so you can digitally sign your LPA during certification.

Once your LPA receives certification, the certificate issuer will proceed to submit the LPA application to OPG on your behalf through OPGO. You do not need to do anything at this stage.

- Application Fees

📝 Form 1 Application:

💲Fees Payable

- No fees for Singapore citizens who submit their LPA Form 1 before 31 March 2026 (U.P. S$70 without fee waiver).

- For Singapore PRs: S$90

- For Foreigners: S$230

📝 Form 2 Application:

💲Fees Payable

-

For Singapore citizens: S$185

-

For Singapore PRs: S$230

-

For Foreigners: S$275

If applicable, OPG will notify you of any application fees via SMS or email after receiving your LPA form. Payment can be made through OPGO using a credit card.

*Please note that these application fees are separate from the professional fee charged by the certificate issuer for certifying your LPA.

-

LPA Registration Processing Time

Your LPA becomes valid only after registration with OPG. This typically takes about 4 weeks after OPG receives your initial application (this includes the mandatory 3-week waiting period).

⏰What is the 3-week mandatory waiting period for?

The 3-week waiting period is to ensure there are no valid objections from your chosen Donee(s) and that all legal requirements are met with. During this waiting period, you also have the option to revoke your LPA if needed.

Once registration is completed, you and your chosen Donee(s) can view your LPA on OPGO.

For a more comprehensive look into the whole LPA online application process, read our article here.

After completing your LPA, it’s worth considering creating a Will, as it complements the LPA by addressing different aspects of your estate and decision-making process.

Will Writing and LPA Services

Both a Will and an LPA serve similar purposes by empowering trusted individuals to act on your behalf in times of incapacity or death.

A Will distributes your assets after your passing and includes instructions for your loved ones. When combined with an LPA, these documents ensure comprehensive care during and after life, aligning with your wishes.

At Guardian Law, we understand the importance of crucial legal documents like Wills and LPAs and are dedicated to making them accessible to everyone. We offer individual services with an LPA certification priced at S$150 and Will creation at S$400. Additionally, we provide a combined package for both your Will and LPA at a discounted rate of just S$475 nett. With our transparent and reasonable pricing, we aim to make these essential documents affordable for individuals from all walks of life, ensuring peace of mind for you and your loved ones.

Feel free to contact us or drop us a message via Whatsapp if you have any further questions.

Furthermore, you can visit our website and browse through our price list and check out the wide range of services we offer.

Introducing WillCraft

At Guardian Law, we understand that drafting a Will can be time consuming, which is why we offer WillCraft, our user-friendly online Will writing service. With WillCraft, creating your Will is convenient and straightforward. You can even do it in the comfort of your own home! Our platform guides you through the entire process, providing tips along the way to ensure your Will reflects your wishes accurately. Additionally, our lawyers can review and witness your Will for a small fee, making us your one-stop destination. Rest assured, you are in safe hands with WillCraft’s transparent pricing and straightforward process.

With your new lifelong document in hand, meticulously crafted in just under 30 minutes, ensures peace of mind and security for you and your loved ones.

Summary

The creation of an LPA is an important consideration for everyone, not just the elderly. It ensures that your welfare and assets are managed according to your wishes, even if you’re unable to make the decisions yourself.

From defining what an LPA is, understanding its importance, to knowing how to create one, we hope this article has provided you with valuable insights. Remember, it’s never too early to plan ahead, it’s about being prepared for life’s uncertainties and ensuring peace of mind for you and your family.

So, why wait?

Take the first step towards creating an LPA today!

Need Help?

Still unsure about the steps to create a Lasting Power of Attorney or if it’s the right choice for you? Let us guide you through the process and address your concerns! Our team at GuardianLaw is here to assist you. Feel free to Contact us here or Whatsapp us and we will get back to you within 1 working day.

We are here to help!

Frequently Asked Questions

What happens if you don't have a LPA?

If you don't have a Lasting Power of Attorney (LPA), your family members do not automatically have the authority to make decisions regarding your personal welfare and financial matters. Should you lose the capacity to make decisions, a family member or anyone suitable would need to apply to the court to be appointed as a deputy to make decisions on your behalf. Setting up an LPA is crucial as it simplifies this process, allowing your appointed Donee to act once your mental incapacity is certified by a medical professional and recognized by the Office of the Public Guardian. This ensures that decisions can be made without the need for a lengthy and potentially stressful court process.

What is a Lasting Power of Attorney (LPA)?

A Lasting Power of Attorney (LPA) is a legal document that appoints individuals to make decisions for you if you lose mental capacity, covering personal welfare, property, and financial affairs. It's a way to ensure your interests are protected if you can't make decisions yourself.

Who can create an LPA?

Any person who is at least 21 years old and mentally capable can create an LPA.

What is the difference between a Power of Attorney (POA) and an LPA?

The main difference between a Power of Attorney (POA) and an LPA is that a POA is effective while you have mental capability, whereas an LPA comes into play specifically when you lose mental capacity.

What are the steps to apply for an LPA?

To apply for an LPA, start by completing the application online and choosing your Donees. Then, your chosen Donees will need to review and accept their appointment online. Finally, visit a Certificate Issuer to have the LPA certified.