Table of Contents

- expand_circle_right Understanding Personal Loans vs. Friendly Loans

- circle The Importance of Documentation

- expand_circle_right Use of Collateral and Guarantors (Optional)

- circle Legal Aspects of Charging Interest on Friendly Loans

- expand_circle_right The Singaporean Terminology: ‘Owe Money, Pay Money O$P$‘

- expand_circle_right Legal Recourse for Borrowers and Lenders

- expand_circle_right Handling Personal or Friendly Loan Disputes

- circle Avoiding Common Pitfalls

Imagine a close friend or relative asking for a loan over a kopi session at your local hawker centre. It’s a familiar scenario in Singapore, but it raises important questions:

“Is it legal?”

“How should you document the loan?”

In Singapore, understanding the nuances between personal and friendly loans is crucial. This article explores these differences, the importance of documentation, and practical tips to ensure smooth lending and borrowing experiences.

Understanding Personal Loans vs. Friendly Loans

Personal Loans

Personal Loans are formal agreements typically obtained from financial institutions like banks. They come with structured terms, interest rates, and repayment schedules.

Example:

If you take a personal loan from DBS or OCBC, you’ll go through a formal application process, including a credit check, and agree to fixed repayment terms. These loans are legally binding and require thorough documentation.

Friendly Loans

Friendly Loans, on the other hand, are informal arrangements between friends or family members.

Example:

Imagine your cousin asking for a few thousand dollars to cover unexpected expenses. Such loans often rely on trust and goodwill, with little to no formal documentation. While convenient, these arrangements can lead to misunderstandings if not properly documented.

The Importance of Documentation

Proper documentation is essential to avoid misunderstandings and potential legal issues. Guardian Law recommends using a friendly loan agreement for its comprehensive nature and enforceability in court.

Here’s a breakdown of the documentation options:

-

Loan Agreement

This is the most secure form of documentation, detailing all terms of the loan, including repayment schedules, interest rates, and any collateral or guarantors involved. It requires signatures from both the borrower and lender, ensuring mutual agreement and providing the highest level of legal protection.

Book a consultation with us today and we can tailor a loan agreement catered to your needs.

-

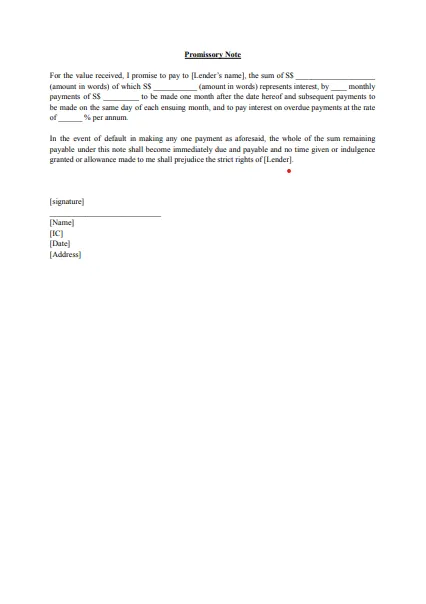

Promissory Note

More secure than an IOU, a promissory note includes specific terms such as repayment schedules and interest rates, making it legally binding. However, it is usually signed only by the borrower, which may leave uncertainties in the contract compared to a loan agreement.

This is an example of a Promissory Note:

-

IOU Template

An IOU is a shorter acknowledgment of debt, typically signed only by the borrower. While suitable for small, short-term loans, it lacks comprehensive terms and may not be effective in legal proceedings if disputes arise.

Use of Collateral and Guarantors (Optional)

For larger sums, securing a loan with collateral or a guarantor can provide significant protection for the lender and clarify the borrower’s obligations.

- Collateral: An asset pledged by the borrower that the lender can claim if the borrower defaults.

For example,

If you lend S$20,000 to a friend for a business expansion and they offer their car as collateral, you can take ownership of the car if they fail to repay the loan.

- Guarantor: A third party who agrees to repay the loan if the borrower cannot.

For instance,

If a sibling borrows money for a home renovation and your mutual parent acts as a guarantor, the parent is responsible for repaying the loan if the sibling defaults.

Including Collateral and Guarantors in a Loan Agreement

When drafting a loan agreement, include clauses about collateral and guarantors.

For example,

Collateral Clause Example: The borrower pledges [Description of Asset] as collateral for this loan. In the event of default, the lender has the right to take possession of the collateral to satisfy the outstanding debt.

Guarantor Clause Example: [Guarantor’s Name] agrees to act as a guarantor for this loan. In the event the borrower fails to meet the repayment obligations, the guarantor will assume responsibility for the remaining balance.

Importance of Including These Clauses

-

Protection for Lenders

Collateral and guarantor clauses provide additional security, ensuring recourse if the borrower defaults.

-

Clarity of Obligations

These clauses clarify the responsibilities of all parties, reducing the likelihood of disputes.

-

Legal Enforceability

Clearly defined terms strengthen the enforceability of the loan agreement in legal proceedings.

By incorporating these provisions, you create a comprehensive loan agreement that protects all parties involved.

Legal Aspects of Charging Interest on Friendly Loans

While it is legal to charge interest on a friendly loan, doing so would trigger a presumption under the Moneylenders Act that you are engaged in moneylending, which could have legal implications. To avoid this, ensure that the loan is not part of a business of moneylending and clearly document the agreed interest rate in the loan agreement.

For example,

Let’s say you lend S$5,000 to a friend to help with their startup, and you both agree on an interest rate of 3% per annum. To avoid the presumption of running a money lending business, it’s crucial to include a clause in the loan agreement specifying that the loan is a one-time, personal arrangement, not intended as part of a money lending business. The agreement might state:

“This loan is made on a personal basis, and the lender does not engage in or intend to engage in the business of moneylending.”

This clear documentation helps protect both parties and ensures that the loan remains within legal boundaries.

The Singaporean Terminology: ‘Owe Money, Pay Money O$P$‘

In Singapore, “Owe Money, Pay Money” is a phrase commonly associated with the expectation of repaying debts promptly. This saying is often heard in everyday conversations but also reflects a more serious issue related to illegal money lending, particularly loan shark activities.

Loan Shark Activities

Loan sharks in Singapore are notorious for using intimidation tactics, such as splashing red paint on doors or leaving pig heads outside homes, to force repayment. These practices are illegal, and both the lender and borrower can face severe legal consequences. For instance, if you or someone you know is being harassed by loan sharks, it’s critical to report these incidents to the Singapore Police Force immediately.

Legal Recourse for Borrowers and Lenders

For Borrowers:

If targeted by loan sharks, take these steps:

- Report to Authorities: Immediately report harassment to the Singapore Police Force via 999 or the X-Ah Long hotline at 1800-924-5664.

- Seek Legal Advice: Consult a lawyer to understand your rights and explore legal protection options.

- Community Resources: Contact organisations like Credit Counselling Singapore for support and practical assistance.

For Lenders:

If lending money, use proper channels:

- Avoid Loan Sharks: Do not engage loan sharks for debt collection; it’s illegal.

- Use Licensed Services: Consider licensed moneylenders or professional debt collectors who operate legally.

- Proper Documentation: Use a comprehensive loan agreement to ensure legal protection and clarity.

- Pursue Legal Action: Take proper legal action in the Court to ensure that your debt is properly returned.

These steps help both borrowers and lenders stay within legal boundaries and protect their interests.

Practical Tips

To avoid disputes and the risks associated with illegal lending, it is essential to set clear terms and expectations upfront.

For example,

If you’re lending money to a friend to cover wedding expenses or to a sibling to help with a home renovation, using a well-documented promissory note can prevent misunderstandings and provide legal protection. Unlike IOUs, loan agreements are more formal and detailed, making them easier to enforce in court.

Handling Personal or Friendly Loan Disputes

Contrary to common belief, the Small Claims Tribunal (SCT) in Singapore does not cover personal or friendly loans, as it primarily deals with contracts for goods, services, and certain tenancy agreements. For disputes involving personal or friendly loans, other legal avenues, such as civil court proceedings, and producing a letter of demand may be necessary to prove evidence for documents and to initiate court proceedings.

Using a Letter of Demand

A Letter of Demand (LOD) is a crucial step before pursuing legal action for personal or friendly loans. It formally requests repayment and warns of potential legal action if the debt remains unpaid.

- Drafting the LOD: Clearly state the amount owed, repayment deadline, and consequences of non-payment. Consider having a lawyer draft it for legal accuracy.

- Sending the LOD: Use registered mail to ensure proof of receipt, which can be useful in court.

- Response to LOD: If the debtor agrees to repay, legal action may be avoided. If not, consider pursuing legal proceedings through the appropriate court.

By using a Letter of Demand, you can attempt to resolve disputes amicably and establish a formal record before considering further legal action.

Avoiding Common Pitfalls

If you are a lender, be cautious about whom you lend to, particularly in informal lending arrangements. Ensure you have proper documentation, such as a loan agreement, to protect your interests.

If you are a borrower, avoid the dangers of loan sharks and accumulating bad debt by borrowing only from reputable sources.

In both cases, always seek legal advice when necessary to understand the risks and obligations involved.

Conclusion

Understanding the differences between personal and friendly loans and the importance of proper documentation is vital. Guardian Law encourages readers to seek legal advice for personalised assistance with loans, ensuring a smooth and legally sound lending experience.

Need Help?

Still unsure about the legal implications of personal or friendly loans? Our team at Guardian Law is here to assist you. Feel free to reach out to us through any of the following channels:

Contact us here or Whatsapp us and we will get back to you within 1 working day.

We are here to help!

Frequently Asked Questions

What is the difference between a personal loan and a friendly loan?

A personal loan is a formal agreement with a financial institution, whereas a friendly loan is an informal arrangement between friends or family.

Are friendly loan agreements legal in Singapore?

Yes, loan agreements are legal. However, be aware when imposing interest rates as you will be presumed to be a moneylender.

Can I charge interest on a friendly loan agreement?

Yes, but charging interest might trigger a presumption under the Moneylenders Act that you are engaged in moneylending, which could have legal implications.

What documentation should I use for a friendly loan?

A loan agreement is recommended for comprehensive terms, but a promissory note or IOU can also be used, depending on the loan's complexity.

What are the benefits of using collateral or a guarantor for a loan?

Collateral and guarantors provide additional security for the lender, ensuring recourse if the borrower defaults.

What should I do if I am harassed by loan sharks?

Report the harassment to the Singapore Police Force immediately and seek legal advice to protect yourself from further threats.

What can I do if a borrower defaults on a friendly loan?

If a borrower defaults, the lender can file a claim in the civil court. Note that the Small Claims Tribunal does not handle such cases. Proper documentation, like a loan agreement, is crucial. The lender may also engage a lawyer to explore legal options or negotiate a repayment plan before taking further action.

Can I use a personal loan for any purpose?

Yes, personal loans are versatile and can be used for various purposes such as home renovations, wedding expenses, or debt consolidation. However, it's important to ensure that the loan terms align with your financial situation and repayment ability.